Nitin Manakchand Zawar and Dr. Rahul Anant Kulkarni

Nakshatra, Housing Society, B. P. Arts, S.M.A Science, K. K. C. Shahu Nagar, Commerce College, Chalisgaon

Email: nitinmzawar@rediffmail.com

Abstract

Faceless assessment represents a watershed shift in Indian tax administration — from traditional, physical, and often discretionary tax officer interactions to a digitized, transparent, and process-driven system. Initiated under the Income-tax Act, 1961, this reform has sought to eliminate geographical jurisdiction, reduce taxpayer harassment, and infuse accountability into the tax assessment process. With the Government of India introducing the Income Tax Act, 2025 to replace the nearly six-decade-old 1961 Act from 1 April 2026, significant structural and procedural changes have been proposed in the assessment regime, including refinements to faceless assessments.

This article provides a comprehensive analysis of the Faceless Assessment Scheme, tracing its legislative evolution, institutional architecture, procedural mechanics, and technological backbone. It examines the scheme’s legal foundation under Section 144B of the Income Tax Act, 1961, and its proposed continuation under Section 273 of the incoming Income Tax Act, 2025. Drawing on judicial pronouncements, academic insights, and stakeholder feedback, the article critically evaluates the operational challenges such as procedural delays, over-engineering of units, and the dilution of natural justice that threaten to undermine the scheme’s original vision.

Further This article highlights the transformative potential of faceless assessment in improving efficiency, and fostering taxpayer trust. It concludes with actionable policy recommendations advocating for structural simplification specifically, the abolition of redundant Technical and Review Units to restore accountability, improve assessment quality, and ensure that the faceless regime fulfils its promise of a fair, efficient, and justice-oriented tax administration.

Keywords: Faceless Assessment, Income Tax Act 1961 (Section 144B), Income Tax Act 2025, Section 273, Section 532, NeAC, Tax Transparency, Digital Governance, CBDT, Tax Reform, Finance Budget.

- Introduction: Tax Law and Administrative Reform in India

India’s taxation system has evolved over decades, anchored for the last sixty years in the Income-tax Act, 1961. Despite periodic amendments aimed at modernizing the system, the legacy Act accumulated complex language, procedural inefficiencies, and litigation challenges. Recognizing the need for a revamped statutory framework, the legislature introduced the Income Tax Bill, 2025, designed to replace the older law with a streamlined, modern, and digitally oriented statute. Among its key reforms is the embrace and enhancement of the faceless tax regime, a flagship reform initiated under the 1961 Act but carried forward and embedded within the 2025 Act’s procedural architecture.Faceless assessment seeks to augment transparency, reduce human discretion, and leverage technology for efficient tax administration. This article analyses the current law’s faceless assessment regime and juxtaposes it with the approach under the new statutory framework.

- Background: The Concept of Faceless Assessment

Stakeholders widely agreed that India’s income tax system was once crippled by a rigid, location-based structure, which bred chronic inefficiency, a profound lack of transparency and entrenched unfair practices. The reliance on face-to-face dealings between taxpayers and tax officers often gave rise to prolonged delays and subjective bias.In the annual conclave of Tax Administration Authorities, “RajaswaGyanSangam”, held in June 2016, Honourable Prime Minister Shri Narendra Modi Ji advocated tax administration reforms through the ‘RAPID’ approach standing for Revenue, Accountability, Probity, Information, and digitization. To transform age-old manual assessment methods, enhance transparency, efficiency, and accountability, and curb malpracticesthe E-Assessment Scheme 2019 was launched on 7 October 2019. The Finance Ministry launched the “Transparent Taxation – Honouring the Honest” platform on August 13, 2020, to ease taxpayers’ burdens and rebuild their trust in India’s tax system. This initiative rests on three key pillars: Faceless Assessment, Faceless Appeal, and the Taxpayers’ Charter. The heart of this reform lies the Faceless Assessment Scheme (FAS). It replaces from a system where tax assessments were conducted by a known officer in a known jurisdiction to one where both the assessing authority and the taxpayer remain anonymous throughout the process. The scheme was conceived not merely as a procedural upgrade but as a cultural and institutional transformation that rebuilds trust between the government and honest taxpayers

- What is Faceless Assessment Scheme (FAS)?

Faceless assessment marks a significant evolution in India’s income tax administration, where the complete evaluation of a taxpayer’s income tax return occurs electronically, without any physical interaction or personal interface between the assessee and tax officials. Launched via the Faceless Assessment Scheme (FAS) in 2020 and integrated into the Income Tax Act, 1961 (as amended), this system aims to minimize discretionary authority of assessing officers, remove territorial jurisdiction limitations, and prevent instances of harassment or undue interference.

The process powered by the use of sophisticated advanced digital platforms, primarily the Income Tax e-filing portal (incometax.gov.in), which facilitates seamless operations. These include automated generation and issuance of notices under sections such as 143(2) or 142(1), secure online uploading of documents and responses by taxpayers, prompt handling of queries or show-cause notices, and electronic delivery of final assessment orders. Officers, based at faceless National e-Assessment Centres (NeACs) and Regional Faceless Centres (RfCs), are assigned cases randomly through algorithmic selection to uphold uniformity and objectivity. This shifts their role from traditional territorial adjudicators to streamlined, technology-enabled processors emphasizing data analysis and regulatory adherence.The rationale and Objectives for faceless assessment Scheme includesAll digital interactions are logged and traceable, reducing scope for arbitrary actions.Centralized processing and AI-assisted case allocation expedite handling which may reduce jurisdictional Bias and enhanced taxpayers experience.

- Faceless Assessment under the Income-tax Act, 1961:

- Statutory Legal Basis: Under the Income-tax Act, 1961, faceless assessment was introduced through Section 144B, empowering the Central Board of Direct Taxes (CBDT) to define the faceless assessment process and procedures. The Central Board of Direct Taxes (CBDT) operationalized the scheme through Notification No. 60/2020 dated 13th August 2020, which laid down the procedural and structural framework for faceless assessments. This notification along with subsequent amendments, established the institutional architecture, communication protocols, and operational guidelines. The provision mandated digital issuance of notices and electronic submissions of responses, including through video conferencing when needed. The key components in Faceless Assessment scheme includes:

- Electronic Notices: Initiation of assessment by the officers should be by issuing digitally served notices.

- Digital Responses: Taxpayers must furnish responses and documents through the Income Tax e-filing portal.

- Random Allocation: The system automatically allocates assessment cases to assessing officers outside territorial jurisdictions except the cases of Search and survey.

- Video Conferencing:Wherever Taxpayers feel that he wishes to explain the things orally as it is difficult to explain on paper he may seek personal hearings online through video conferencing if necessary. In this process also identity of the officer is not disclosed.

- Audit Trail: Comprehensive logging ensures accountability and traceability.

- Operational Workflow

The faceless assessment workflow under the 1961 Act generally involved:

- Notice Issuance: The e-filing system issues assessment notices (e.g., under Sections 142(1), 143(2), or 148 etc.).

- Document Submission:After receipt of the notice taxpayers upload his submission along with supporting documents and respond to queries online.

- Assessment Draft order:Assessing officer prepare draft assessment order based on various submission made by the taxpayers and data collected by him by issuing notice U/s. 133(6) of the Income Tax Act 1961.

- Submission against Draft order: Taxpayers can either object the draft order or accept the order after verification of the draft order.

- Video Conferencing: Assessee can opt for the Video conferencing for argue the case orally.

- Revised or Final order: After verification of submission to draft order Assessing officer prepare final order and send it for approval.

- Quality Review: Independent review panels ensure quality and fairness of the order.

- Final Assessment Order:After all this process the final Assessment order is issued electronically in compliance with statutory timelines.

- Limitations and Challenges of the 1961 Faceless Assessment Scheme:

While faceless assessment marked a significant improvement, several limitations under the 1961 Act emerged. Major limitations are:

- Technological Adaptation: Older provisions were adapted to digital procedures but not inherently drafted for modern technology.

- Procedural Complexity: Notices and responses under the 1961 Act require interpretation of multiple sections and cross references which could complicate digital automation.

- Limitation of Space and size for document upload: The submission and relevant document uploaded through income tax portal is having limited space. At a time only 10 attachments can be upload and single attachment should not be more than 5 MB in size. It creates difficulty to taxpayers while submitting the submission.

- Limited Scope for Clarification: Some taxpayers faced delays when seeking online hearings or clarifications.

- Litigation Bottlenecks: Despite digital procedures, disputes continued due to ambiguities in language and procedural overlaps.

These concerns set the stage for a reimagined legislative approach under the Income Tax Act, 2025, which aims to build a more coherent digital assessment framework.

- Overview of the Income Tax Act, 2025

The Income Tax Act, 2025 represents a comprehensive overhaul, replacing the fragmented 1961 law. It aims to achieve simplicity, efficiency, and taxpayer clarity. Key features include:

- Reduced Length and Complexity: Sections are reduced from over 800 in the 1961 Act to 536, and the overall legislative language is simplified.

- Unified Tax Year Concept: The traditional previous year and assessment year are eliminated, replaced by a single tax year concept.

- Digitization Emphasis: Enhanced digital compliance tools, including faceless assessments and digital notice systems.

Importantly, the new Act will come into force on 1 April 2026, with new Income Tax Return (ITR) forms and rules notified prior to implementation. New Income tax rules are yet to be notified.

- Faceless Assessment under the Income Tax Act, 2025:

- Codification and Redrafting:Under the Income Tax Act 2025, provisions related to faceless assessment have been redrafted and consolidated to align with the overall objectives of clarity and digital orientation:

- Consolidation: The old Section 144B of the 1961 Act, which detailed faceless assessment procedures, is re-drafted as Section 273 (or equivalent) in the new Act, ensuring a cohesive approach that is integrated with other digital compliance mechanisms.

- Scheme Power: Section 532 empowers the Central Government to frame faceless schemes eliminating interface with taxpayers, a structural enhancement reinforcing the digital approach across procedures.

- Procedure Clarity: Notices, responses, and procedural steps are consolidated and clarified, aiming to reduce ambiguity and streamline compliance.

- Key Changes and Enhancements:

The new Income Tax Act 2025 approach includes Broader Digital Integration. Faceless assessments are deeply integrated with the Act’s digital infrastructure. Enhanced tools includethe statutory design envisions algorithmic distribution of cases to reduce bias and improve turnaround, Digital service of notices and assessment outcomes remain core components and use of Artificial intelligence for assessment procedure.These reinforce the objective of zero physical interface between the taxpayer and tax officials. The new Act expands what constitutes information for the purpose of issuing notices including directions from approving panels and findings from judicial or tribunal orders. This is procedural but critical in digital notice scenarios.

- Procedural Simplification

By removing redundant procedural provisions and presenting faceless assessment provisions in a consolidated format.The Income Tax Act 2025 Act aims to Reduce confusion arising from historical cross-referencing of multiple sections, simplify notice issuance requirements and timelines and importantly harmonize digital process steps across assessment, reassessment, and appeals.

- Comparative Analysis: Faceless Assessment in 1961 vs 2025 Act:

The transition from the Income-tax Act, 1961, to the Income Tax Act, 2025, blends continuity with significant transformation across key aspects of tax administration. Under the 1961 Act, the statutory base for faceless assessments relied on Section 144B, which tied provisions to the Act’s procedural context, whereas the 2025 Act integrates these into a native digital procedural architecture with consolidated provisions under newer sections and scheme-making powers.

The digital interface evolved from gradual adaptations of existing e-filing systems in the 1961 framework to a fully cohesive, native digital orientation in 2025, supported by streamlined statutory rules. Procedural complexity decreases notably in the new Act, moving away from the legacy language and cross-references of 1961 toward simplified phrasing, consolidated steps, and table-based presentations for greater clarity.

Integration with other procedures also advances, as the 1961 Act maintained separate rules for assessments, reassessments, and appeals, while the 2025 Act aligns them into unified digital workflows across compliance processes. Notice information scope expands under 2025 to incorporate directions from panels and judicial findings, beyond the traditional definitions of the old Act. Finally, taxpayer engagement tools progress from basic video conferencing permissions in 1961 to enhanced digital tools and explicitly clearer procedural rights in 2025.

This comparison underscores that while the core objective of faceless assessment remains unchanged viz. transparency, efficiency, and non-discriminatory processing.The Income Tax Act 2025 execution model embeds the digital approach more fundamentally into the legislative fabric.

- Benefits of Faceless Assessment Regime:

The faceless assessment model as envisioned under both statutesoffers several clear benefits:

- Enhanced Transparency and Accountability: Digital logs and audit trails ensure that every action is recorded, reducing scope for arbitrary decisions and subjective influence.

- Reduced Taxpayer Harassment: By eliminating geographical jurisdiction and physical interfaces, taxpayers are less likely to face intimidation or discretionary pressure.

- Faster Processing: Algorithm-driven case allocation and automated notice systems contribute to quicker assessment cycles, potentially reducing backlogs.

- Wider Accessibility: Taxpayers even in remote locations can engage with the system on equal footing through digital platforms.

- Litigation Reduction (Long Term): Clearer procedures and reduced ambiguity may lower litigation rates by providing predictable outcomes.

- Challenges and Considerations:

Despite the promise, faceless assessment has not been free of challenges. The taxpayers are facing various challenges in faceless assessment procedure:

- Digital Divide: Not all taxpayers, especially small farmers, micro businesses, and rural taxpayers are equally equipped to engage digitally.

- Technical Glitches: System downtimes, technical faults, and data aggregation errors can disrupt processes.

- Procedural Ambiguity: While the 2025 Act simplifies language, transitional challenges and interpretation issues may arise.

- Privacy Concerns: Though not directly tied to faceless assessments, related debates about digital access to taxpayer data emphasize the need for robust data protection in digital tax regimes.

- Space for Data upload: The space limitation for uploading data results in undue hardship to the assessee for uploading bulk data at one instance. It results in time consumption and harassment of assessee.

- Analysis of Taxpayers view about the Faceless Assessment scheme:

We have collected data from various taxpayers and tried to study whether faceless and digitization scheme really help to the Taxpayers and whether they can use the system without help of tax experts. The detail analysis is as under:

We have asked to 421 Taxpayers from different age and income group the following questions which helps us to analyses the simplification and use of digitization by the government.

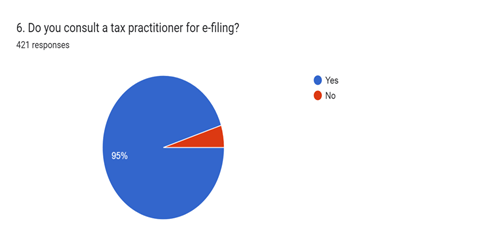

- Whether Taxpayers have to consult Tax practitioners for e filling?

From the above chart We can analyze the data which shows that out of 421 taxpayers 400 taxpayers are consulting with tax practitioners for e filling of Income Tax Return. Only 21 taxpayers responded that there is no need to consult tax practitioners for e filling. It represents that 95% of taxpayers still need help of Tax practitioners for e filling of Income Tax Return.

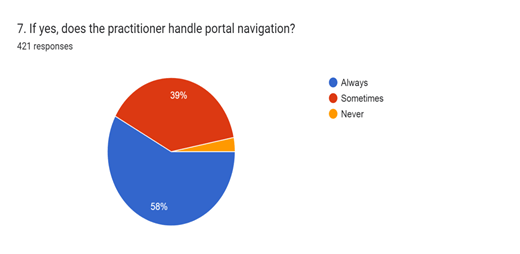

- Does the Tax practitioners handle portal navigation?

From the above chart We can analyze the data which shows that out of 421 taxpayers 244 taxpayers portal is always navigated by his tax practitioner only which works out to 58% of taxpayers. 164 Taxpayers portal is sometimes navigated by tax practitioners and sometimes Taxpayers try to access the same which works out to 39% of the Taxpayers. Only 13 taxpayers are navigating the income tax portal their own which works out to 3 % of total population of taxpayers.

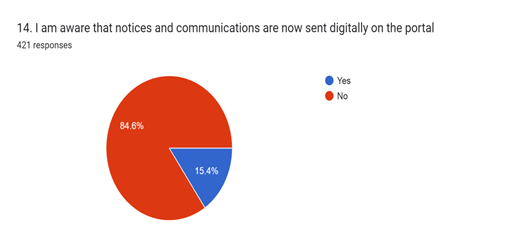

- Taxpayers are aware that notices and communications are sent digitally on the portal.

It is analysed that out of 421 respondents 356 respondents are not aware that notices and communications are sent digitally on portal which works out to 84.6% of the population. Which means only 65 out of 421 respondents are aware that the notices and communications are sent digitally by the department which works out to only 15.4% of the population.

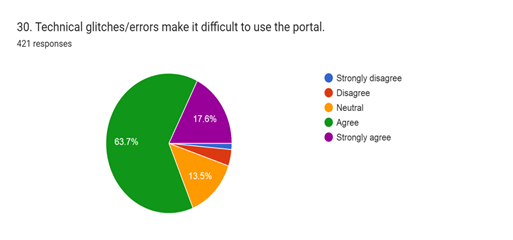

- Technical Glitches / errors make it difficult to use the portal.

It is analysed that out of 421 respondents 74 respondents strongly agree and 268 respondents agree that technical glitches / errors make it difficult to use the portal. Hence total respondents who are strongly agree and agree works out to 81.3% of the population. 13.5% (57 respondents) are neutral and 5.2% (22 respondents) are disagree that the technical glitches / errors make it difficult to use the portal.

- Conclusion:

Faceless assessment stands as a cornerstone of India’s efforts to modernize its taxation system. Introduced under the Income-tax Act, 1961 with clear goals of efficiency, transparency, and reduced taxpayer harassment, its evolution under the Income Tax Act, 2025 marks a significant legislative maturation. The new Act embeds digital procedures more deeply and coherently, reflecting lessons learned from over a decade of faceless assessment experience. The income tax department is trying to simplify the income tax act and process for e-filling and e-assessment but it needs to conduct various outreach program to reach the taxpayers and explain them the functionality of income tax portal as well as make them aware about the simplified Income Tax Act introduced by the government of India.

While the journey of implementing faceless assessments continues to face practical challenges, the comparative transition from the 1961 framework to the 2025 statutory design represents an important stride towards a digital, citizen-centric, and dispute-resilient tax ecosystem. As India transitions to the new regime from 1 April 2026, taxpayers, practitioners, and administrators alike must understand the changed legal landscape to ensure compliance, effective participation, and realization of the core objectives of a modern tax system.

References:

- Income Tax Act, 1961, Section 144B.

- Website of Income Tax Department: https://www.incometax.gov.in/iec/foportal/

- CBDT Notification No. 60/2020, dated August 13, 2020.

- Income Tax Act, 2025 (as proposed), Section 273 and Section 532.