Stepping out on your own and building a business from scratch can feel overwhelming, but it’s also one of the most rewarding adventures you’ll ever experience. If you’re contemplating your first entrepreneurial leap, you’re not alone. Every thriving brand, local cafe, and tech giant began with someone’s single idea and the courage to bring it to life.

Discover a Niche That Blends Passion and Profit

Pinpointing your niche is the starting point of every successful business story. The right business idea balances two key ingredients: your passion and a genuine market opportunity.

How to Identify the Right Business Idea

- List your interests, skills, and experiences

Jot down what excites you, areas where you excel, and industries you’ve worked in.

- Study the market

Look at current trends, gaps, and problems begging for solutions. Conduct surveys, browse forums, check what’s trending on social, and talk to potential customers.

- Evaluate profitability

Ask yourself, “Are people willing to pay for this?” A good idea solves a problem people care about enough to spend money on.

- Test with a minimum viable product (MVP)

Before going all-in, launch a simplified version of your offer to real customers. Gather feedback and adjust quickly.

Build Your Blueprint with a Solid Business Plan

A business plan is your roadmap. Think of it as the tool that translates inspiration into a practical path forward.

Key Steps to Drafting Your Business Plan

- Executive summary

Briefly introduce your business, covering your vision, goals, and what makes your idea unique.

- Business description

Lay out what your business will do, the target audience, and how you’ll stand out from the competition.

- Market analysis

Showcase thorough research about your competitors, industry trends, and your ideal customer profile.

- Organization and management

Describe your structure. Will you be a sole proprietor, or is this a partnership? List out your team members and their roles.

- Products or services

Detail what you’re offering, your pricing strategy, and potential future expansion.

- Marketing and sales plan

Outline your approach for reaching customers, from digital campaigns to referral incentives.

- Financial projections

Present a budget, projections for revenue and expenses, and funding requirements for growth.

- Appendices

Add extra details like your resume, permits, or supporting data as needed.

A thoughtful plan helps keep you focused, attracts investors, and acts as a reference as your project evolves.

Explore Your Funding Options

Once your blueprint is complete, it’s time to find the capital to fuel your dream. There’s no one-size-fits-all approach—instead, weigh your choices and select the best fit for your ambitions and appetite for risk.

Popular Ways to Fund Your Venture

- Bootstrapping

Many entrepreneurs begin by self-funding (using savings, personal loans, or even credit cards). This method gives you maximum control but requires financial discipline and risk tolerance.

- Borrowing from friends and family

Loved ones can provide early backing, but formalize the arrangement to protect your relationships.

- Bank loans or credit unions

Consider traditional business loans if you have a solid plan and decent credit history.

- Angel investors and venture capitalists

If you need significant funding and have a scalable business model, pitching to angel investors brings both capital and valuable advice.

- Crowdfunding platforms

Crowdfunding sites can generate funding and early buzz for your product.

- Small business grants

Many government and private programs exist, particularly for businesses advancing technology or addressing social issues.

Tip: Mix and match options when needed, but always keep an eye on how much control and equity you’re giving away.

Market and Brand Your Business for Maximum Impact

You’ve built a great product, but now you need people to notice. Effective marketing and strong branding set your business apart and attract loyal customers.

Branding Basics for First-Time Entrepreneurs

- Create a memorable brand identity

Start with a catchy name, compelling logo, and cohesive color scheme. Consistency is key.

- Craft a resonant story

Share your “why.” Customers love connecting with brands that stand for more than just sales.

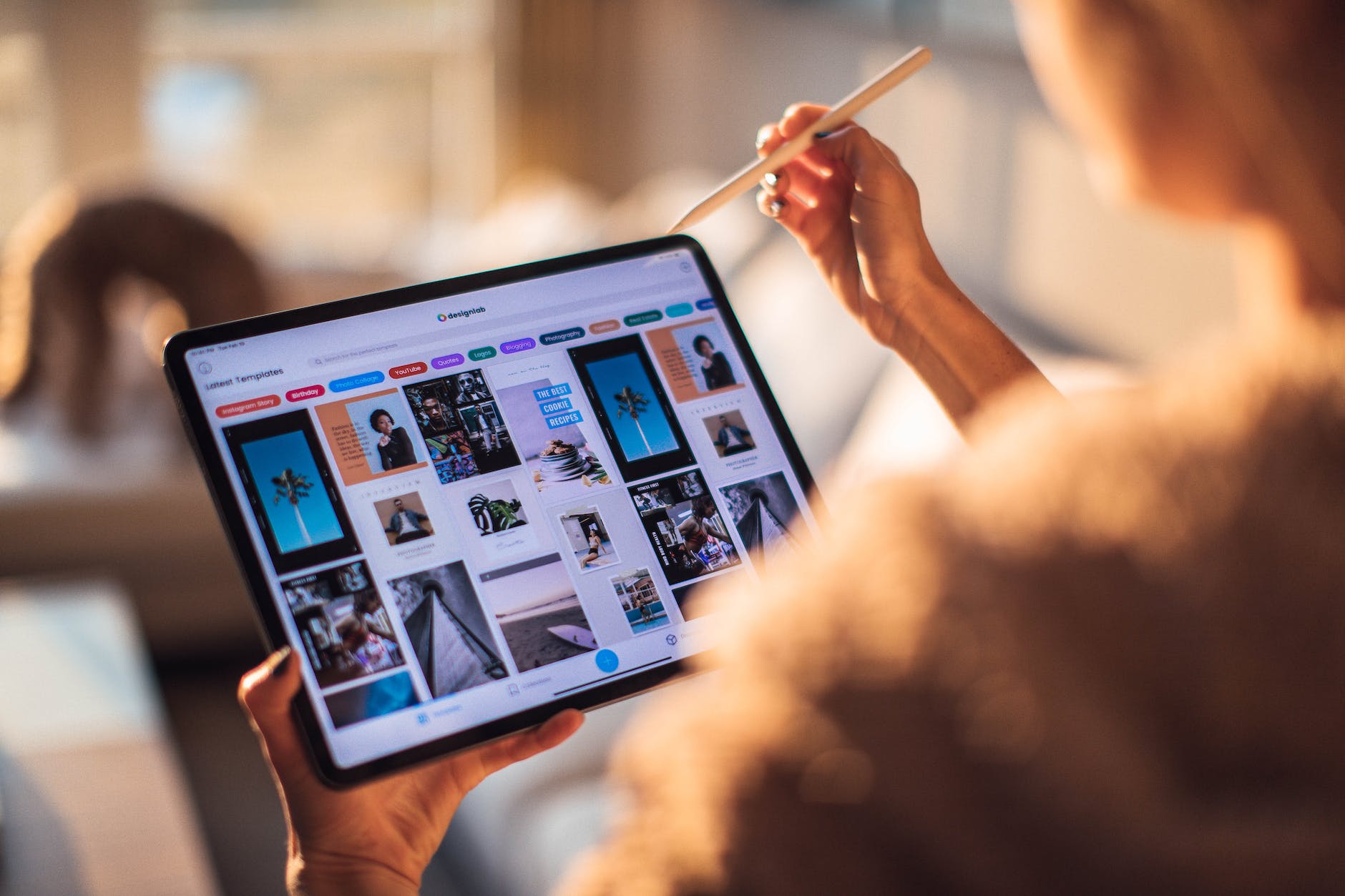

- Develop an engaging online presence

Build a clean, user-friendly website and set up social media accounts where your audience spends time.

- Define your unique value proposition (UVP)

Clarify what makes your offer different from competitors, in just a sentence or two.

- Focus on customer experience

Make it easy for people to engage with you, offer responsive support, and invite feedback.

Winning Marketing Tactics

- Content marketing

Publish helpful blog posts, videos, or guides to build authority in your space.

- SEO and local optimization

Optimize your site and listings for relevant keywords, so potential clients find you easily.

- Social media

Use social media platforms like Instagram, LinkedIn, and TikTok (as appropriate for your audience) to build buzz and community.

- Referral and loyalty programs

Motivate your fans to spread the word and reward their loyalty.

- Email marketing

Nurture leads and customers with updates, tips, and special offers.

Navigate the Legal Landscape with Confidence

Dealing with legal paperwork may not be glamorous, but it protects your interests and supports long-term growth. Taking shortcuts can lead to costly headaches later on.

Legal Essentials for New Entrepreneurs

- Choose the right business structure

Options include sole proprietorship, partnership, LLC, or corporation. Each has different tax and liability implications.

- Register your business

Obtain the licenses and permits required in your location and industry.

- Ensure cybersecurity

Protect your business and customer data by implementing network security, like that offered in South Jordan.

- Understand tax obligations

Stay informed about federal, state, and local taxes, including sales tax if you’re selling products.

- Protect your intellectual property (IP)

Consider copyrighting your content, trademarking your brand, and securing patents if applicable.

- Set up strong contracts

Use clear agreements for partners, vendors, and clients.

Conclusion

Understanding the basic legal requirements for starting a business is key, but staying updated on any changes that impact your industry or location is just as important. Regularly reviewing and updating your legal documents, contracts, and policies ensures they keep pace with your growing business. By protecting your business legally, you can focus on building a thriving, sustainable enterprise.